What is Account Takeover Fraud?

Account takeover is a fraud in which bad actors use stolen credentials to possess real credit cards, shopping, or even government benefits account is one of the most known forms of identity theft.

How it Happens?

Account takeover fraud (ATO) occurs when a cybercriminal gains access to the victim’s login credentials to steal funds or information. Fraudsters digitally crack into a financial bank account to take control of it and have a variety of techniques at their disposal to attain this, such as phishing, malware, and man-in-the-middle attacks, among others. ATO is a top threat to financial organizations and their clients due to the financial losses and mitigation efforts.

The growth of digital communication and data storage means cybercriminals have several entry points when endeavoring to gain access to users’ personal information. Also, people are often bad at using robust passwords. Cybercriminals do not need sensitive information to gain access to an account. They will seek out the simple entry point and build the account takeover. It can start with any piece of personal data used when logging in, such as an email address, full name, date of birth, or city of residence, all of which are found with minimal research.

Once a hacker has taken over a user’s main communication channel, they can change everything the account gives them access to, such as security questions, passwords, encryption settings, usernames, etc. This complete lockout can even make the actual user look suspicious when trying to resolve the problem since they would no longer know the updated information associated with the account.

Here is the list of the Top 5 companies which prevent Account Takeover Fraud:

- AuthSafe Intelligence

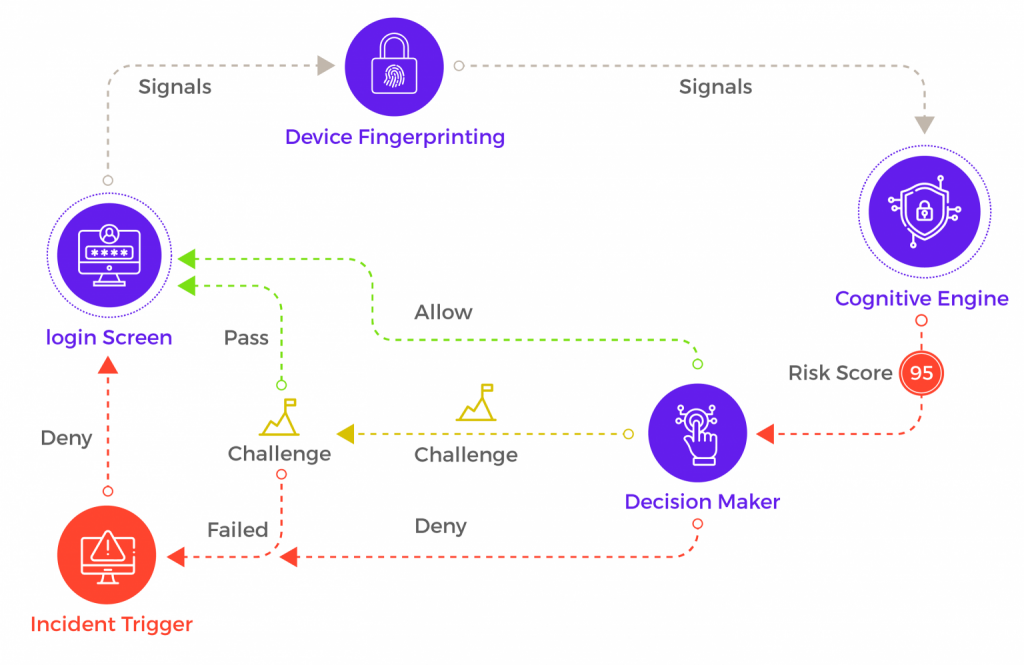

AuthSafe will predict, detect, prevent, and respond to online fraud attacks in real-time using the cognitive engine. safe’s technology helps to prevent all manners of Account Takeover efforts and new online fraud account registration attacks. Through manual attempts or automated tools methods, including credential stuffing. High precision on identifying the sign of account takeover (ATO) and labeling suspicious devices or compromised devices. The cognitive engine builds the risk score for the registered device and assigns the accurate score based on the signals. All the verdicts shared via webhooks are real-time with no delay. Reduction in business risk exposure using Authsafe cognitive engine. There more than 25+ Signals assessed by AuthSafe’s Cognitive engine.

- Ravelin Technology

Ravelin Technology is like a rampart or fortification atop a mediaeval stronghold, making those inside safe, secure, and defendable. The emblem depicts a starfort with numerous ravelins incorporated into it. In 2014, Ravelin was established. To help you stop evolving fraud risks and take payments with confidence, Ravelin offers cutting-edge technology and committed support. Ravelin creates specialized solutions based on your company’s needs to identify fraud signals earlier and lower the cost of fraud. Improve your business strategy by gaining a deeper understanding of customer behavior and networks. The investigators at Ravelin strengthen your team’s data science capabilities and help you achieve your objectives. Ravelin gives analysts the ability to examine orders, gadgets, and successful logins connected to ATO and to prevent new logins. To prevent client churn and safeguard your brand, lastly, assist customers in maintaining their accounts.

- Arkose Labs

For enterprises, organizations, and sectors, Arkose Labs offers fraud prevention, antispam, and abuse analysis services. The Arkose Labs is aware of the possibility of utilizing dynamic, approachable puzzles in the authentication process. The company combines cutting-edge risk-based profiling and targeted challenges to combat fraud. Arkose Labs provides long-term security against account takeover. Arkose Labs uses its global risk engine in conjunction with adaptive step-up challenges to make it more and more expensive for fraudsters to plan massive assaults. Arkose Labs uses continuous intelligence to monitor all activity and delivers targeted friction to suspect users in order to precisely identify fraudulent behavior. Genuine users have the opportunity to prove their legitimacy by quickly solving authentication hurdles. These challenges prohibit fraudsters from carrying out large-scale account takeover attacks by dramatically increasing the time and resources required to properly perform authentication procedures at scale.

- Forter

Forter is a fully automated platform that bases its decisions on a thorough understanding of identification for every eCommerce contact. Utilizing consumer insight to provide everyone with the eCommerce experiences they deserve has been their main goal from day one. Its headquarters are in New York, with offices also in Tel Aviv, London, Singapore, and New York. Former employees of Fraud Sciences who were software engineers launched the business in 2014. Forter’s technology is classified as fraud analytics by Gartner Group. This includes methods like soft linking, which allows users to be connected even when no overt information is exchanged, behavioral monitoring of consumers’ well-established shopping habits, and other methods.

- Shield

Businesses can use Shield‘s real-time analytics to identify users and devices that are acting riskily. By enabling businesses to ban undesirable individuals, deter fraudsters, and enhance user experience, trust between parties can be established. Accurately spot account takeover warning indicators, such as a single device accessing lots of users’ accounts with a thorough grasp of the risk level associated with each technology, and make wiser judgments. Learn more about the interactions between your devices, users, and other factors. Find out exactly what tools scammers use to hijack accounts. Utilize the largest fraud library in the world, comprised of 7 billion devices and 700 million user accounts, to identify fresh and unidentified ATO assaults.